Property Tax Values

Appraisal Values Just Don't Add Up

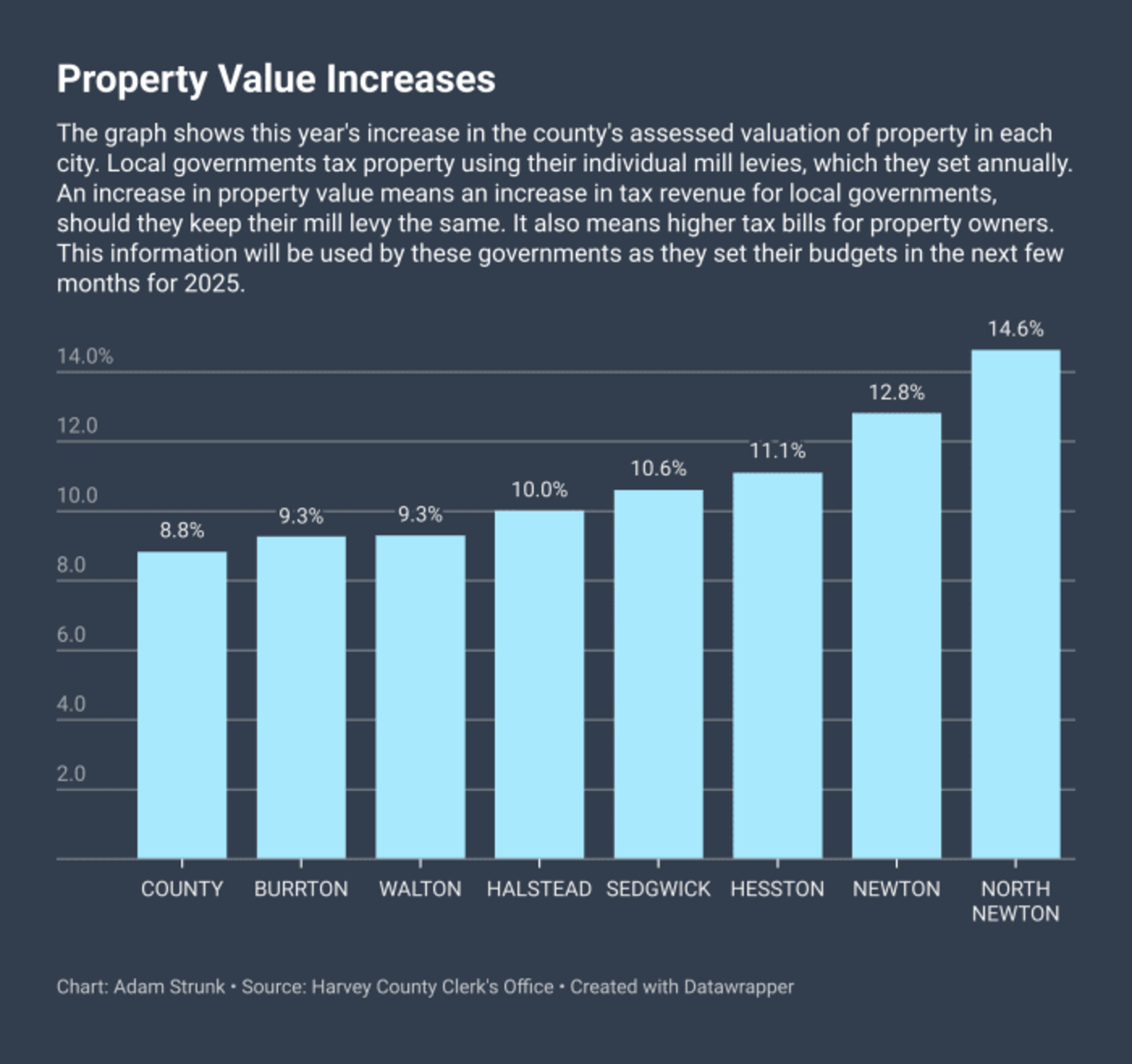

For two years, Kansas property owners have tried to make sense of property tax statements that reflect increased values in property that are driving tax bills into the danger zone for many Kansas families. Who determines that increased value resembles a game of ping pong between county assessors, County Commissioners, members of the Kansas legislature, and Kansas Department of Revenue Property Assessment Value Director, David Harper. The who and why make things murky about answers given to property owners that protest the values, and it becomes even muddier when examining the changes to the appraisal process that has been the best-kept secret of the Kelly Administration.

Fair vs Equitable Is the NEW Appraisal System

The new system is riddled with changes in statutes. Here is the short version of how Kansas became the state that literally is taxing property owners off their land in the name of equity. The cast of perpetrators include Governor Laura Kelly's adopted Justice 40 Initiative from the Biden Green New Deal, Kansas Department of Revenue Property Assessment Value Director David Harper, a software company instrumental in building cloud-based data systems with A.I. capabilities (Tyler Technology Inc.), grant funder Kansas Information Network (INK) Board, Kansas Department of Revenue's data collecting tool KANPAY, and a host of legislative changes from the Kansas legislature who ushered in "mass appraisal" by computer technology into Kansas Law. This represents a massive loss of private wealth for Kansans. 2022 alone generated $5 billion new tax dollars and removed those dollars from local economies. (by www.standforthelandkansas.com)

Conservative legislators at the state level are working tirelessly to untangle the web of tools used to deplete Kansans of their private wealth. This is an urgent and pressing issue at the state and county level in the next few years because of the double taxation from increasing property values and subsequent insurance rates burdening each property owner. Legislators in both parties agree that the personal and property taxation systems are taxing folks out of their homes and their property.

Example: During a recent work session, the county commissioners had a phone call with the State Property Valuation validation office. The representative could not tell us how to fix that or the repercussions if we did not become compliant. If they don’t know, how could our county staff know?? I contacted the State Office and then I was transferred to the third person, who also didn’t know but within a few hours he was able to research the issue and send me some information.

Essentially, there are no repercussions, unless we are far out of compliance for quite some time. Pretty ambiguous, huh? However, in the email I received, the State doesn’t appear to be concerned about Harvey County being ‘out of compliance’. Now, I tend to be a little Type A and certainly do not like hearing I’m non-compliant with anything. But I do not see the necessity to raise property taxes to this extent in one year.

I asked the Commissioners what role they have in setting the property valuations and the only thing they do is appoint the county appraiser. I asked if we have any recourse, such as a class-action appeal or does each household need to appeal individually. They really didn’t have an answer.

When Property Tax Decisions were Local Decisions

The Kansas Appraisal and Property Tax Procedures adopted by Counties to keep Property Tax in line with county budgets was always directed by the County Appraiser's office. Appraisals were conducted on around 17% of the property parcels in the county each year. Those 17% of parcels were then evaluated for changes to the Property due to construction, improvements, land use, and sales comparatives and then recorded in the CAMA Mapping System to keep property information current. In short, appraisal changes on any property were updated every six years. Property owners with no intention of ever selling were reviewed every six years.Fair or Not, property owners could find their way to the County Appraiser's Office and get an answer to appraisal changes that made sense.

I urge you to contact the Commissioners and ask them to act on the citizens’ behalf to cut the amount of tax increase this year. You can do that here:

Becky Reimer (harveycounty.com)

Randy Hague (harveycounty.com)

Don Schroeder (harveycounty.com)

If you’d like to explore the world of property taxes, you can do that here:

Property Taxes By State - PropertyTax101.org